EigenLayer | What Is It?

Scale Ethereum? Nah. Hyperscale.

Eigenlayer | What Is It?

Eigenlayer has taken the market by storm in the past few weeks, possibly fuelled by the liquid staking derivatives (LSDs) narrative that made people go high. Pun intended.

In this article, we will be taking a deep dive into Eigenlayer, understanding what it is, the pros and cons, the current applications and the future of it.

At the end of this article, I've written about my questions and concerns about Eigenlayer. Feel free to dm me on Twitter @jinglingcookies or just drop a comment on the thread and we can discuss more on it! Always open to hearing more opinions :D

Key Takeaways

The creation of trust network is difficult and cost ineffective

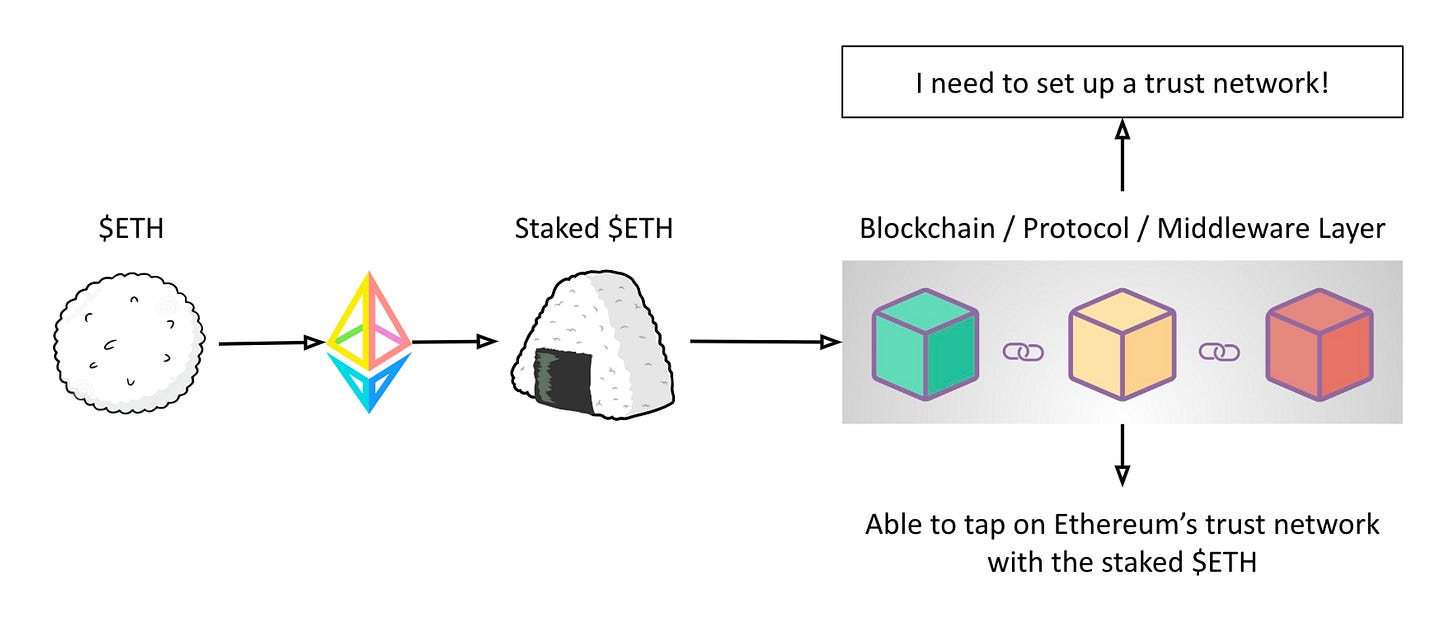

Eigenlayer allows blockchains and protocols to leverage on Ethereum’s strong security through ETH re-staking

EigenDA, the first protocol built on Eigenlayer is a specialized data availability layer that can achieve up to 15MB/s in throughput. This is 176 times that of Ethereum without danksharding

DITL (Describe In Two Lines)

Yes. I’m trying to set the trend. But jokes aside, let’s try and summarize what Eigenlayer is about in two lines. Not an easy feat considering how extensive this technology is.

Eigenlayer is an infrastructure that allows for staked ETH to be re-staked to other middleware/blockchain/protocol. This allows the leveraging of Ethereum’s existing strong security and trust layer.

Whuuuutttt? Yea no problem, that’s how I felt when I first came across it too. Makes sense ish but sounds a little bonkers too. Eigenlayer is a technology that affects both the downstream and upstream aspects of an ecosystem, and as such is more complex than just two sentences. Let’s look more into it, step by step.

What is Liquid Staking?

Before we move on to anything. We need to first understand the basis of how this is possible: Liquid Staking Derivatives (LSDs).

Simply put, liquid staking allows users to simultaneously participate in the DeFi ecosystem while staking their tokens. LSDs have thoroughly captured the market’s attention in the last month, riding on the narrative of capital efficiency.

The Shanghai Upgrade planned for March 2023 was also speculated to be a huge catalyst for this price action. Given that it becomes more certain as the Shanghai upgrade draws close, the market might have increased their confidence in liquid staking protocols, fuelling the demand for liquid staking tokens and driving the prices up.

Liquid staking is mainly targeting the user aspects, where they are allowed to continue earning yield from other aspects of DeFi, while earning staking yield. However, there exist a whole suite of challenges that are being faced by the underlying blockchains and protocols which are not being addressed. Let’s look more into what this entails.

What is the Problem?

To have a better understanding as to what the current problem is, we will be using the following analogy.

Ethereum: Shopping mall

dApps and Middleware: Shops

Consensus Mechanism: Lifts

Trust Network: Concrete floor

Imagine Ethereum as a shopping mall. Makes sense because it is a smart contract platform that allows the building of decentralized applications (dApps). In this shopping mall, we need shops. These shops refer to the middleware that Ethereum uses, such as oracles and message exchange mechanisms. In addition, there are also dApps that are being built on the layer.

But instead of having a central lift in the shopping mall that everybody can use to access the shops, the shops have to build their own individual lifts for users to get to them. In addition, instead of being able to use Ethereum’s building contractor that has built sturdy floors and walls, the shops have to find their own contractors to build the architecture around them.

With this mechanism, there is a myriad of problems.

1. Difficulty and Cost Inefficiency in Establishing Security

Security has always been a head scratching factor, yet an extremely important one that has to be considered by builders. This is because the downside of not having a robust security essentially puts the network at risk, including all the data and value being stored on it.

For a trust network to be built up, a new validator set has to be bootstrapped. However, there needs to be a sufficiently large amount of validators that has to come onboard to secure the network in order to achieve decentralization, preventing any form of concentration risk which could attack the network.

In addition, is it often the case where incentives have to be given out for validators to be willing to secure a network. This becomes highly cost ineffective, for networks will have to first fork out a large sum in bootstrapping the validator set. Thereafter, they will have to continue dishing out incentives to ensure that these validators stay on.

The need for a large number of validators coupled with the incentives needed eventually leads to a high cost of securing security.

Imagine this with the shopping mall analogy. Shops will have to fork out a large amount to first build the lift. After which, they will have to continue maintaining it with monthly payments.

2. Misalignment of Protocol Interests

Since the protocols are all secured by different trust networks and have different consensus mechanisms, there is no inherent alignment of interests. As such, there is no common ground for these protocols to innovate, curbing the rate of innovation within the industry.

In addition, given that everybody is competing against each other to bootstrap a limited set of validators, the trust network eventually gets more fragmented as more protocols are spun up. This is detrimental to the blockchain ecosystem as a whole.

3. Lack of Trust in Other Protocols

Ethereum does not run entirely on its own. There are aspects which it depends on external resources. For example, using oracles to draw accurate prices, communicating with other chains through cross-chain message exchanges. This has become an even more prevalent phenomenon given the transition from monolithic to modular blockchain in order to achieve greater scalability.

However, a lot of these other layers that Ethereum relies on have different consensus mechanisms to suit what they are prioritizing for. Given that Ethereum is relying on such middleware layers that have a different trust network (to which is not as strong as Ethereum), how reliable will it be? These are all potential security risks that users will have to sit with.

What is Eigenlayer?

Enter Eigenlayer, here to solve all of the above problems.

Eigenlayer is a middleware built on Ethereum, and is commoditizing Ethereum’s trust network, allowing new chains or protocols to leverage on this highly secure decentralized trust.

Stakers that have staked their $ETH to secure the Ethereum network can take their staked $ETH and re-stake it to other chains or protocols. Confusing? Let’s understand it with Onigiri.

With this, the new chains or protocols can now leverage on $ETH’s trust network.

Stakers are exposed to higher risk due to the increase slashing potential that is accumulated across the different chains or protocols. To compensate for this increased risk, stakers are rewarded with higher yield that is accumulated across the chains or protocols they decide to re-stake on.

As mentioned by the founder, Eigenlayer was built on Ethereum as it is the largest programmable decentralized trust network. Eigenlayer works to unbundle this trust network, allowing components of it to be delegated to other purposes.

Eigenlayer’s Use Case: EigenDA

Let’s get the ball rolling with the first application built on Eigenlayer: EigenDA.

EigenDA is a data availability layer that brings about a new model to the current data availability landscape. In a nutshell, EigenDA allows Ethereum to offload its data availability within the ecosystem security instead of going off-chain.

This is made possible through a dual quorum model where one quorum is run by Ethereum’s staking economic quorum, and other other is run by Rocketpool’s $ETH stakers (or other liquid staking platforms). In order to achieve data availability, one would need to obtain both quorum. This can be seen as a combination of economic trust and decentralized trust.

EigenDA is a pure data availability layer, and as such, even in its current state its able to achieve up to 15 MB/s throughput, which is 176x more than the current throughput of Ethereum without danksharding. The founder Sreeram highlighted that EigenDA is essentially built by leveraging on Eigenlayer’s higher degree of freedom, while taking danksharding’s core cryptographic architecture. With this, EigenDA’ expected throughput for the future will be 1 GB/s.

Eigenlayer’s Traction

One of the main highlights would be the utilization of EigenDA by Mantle, a modular Layer 2 (L2) built by BitDAO. The team at Mantle mentioned that their choice of EigenDA was attributed to the high througput and security guarantee that could be obtained.

An interesting aspect of this would be the dual token staking model. With this model, the underlying security of the protocol can be obtained through two methods

Staking of Protocol’s Native Token

Re-staked ETH

In my opinion, this is a good boost for protocols that have started and have yet to build up their community. In the long term when protocols have bootstrapped their users and built a stronger community, they can then start to rely less on the security derived from re-staked ETH, and focus on the security provided by staking of protocol’s native token. This pushes forth an environment that is very welcoming towards the creation of new protocols, allowing a more rapid pace of innovation.

Pros of Eigenlayer

Till this point, I believe you have a rough idea of what Eigenlayer is about and the benefits it brings. Unless my writing is so bad that you didn’t manage to understand… DO LET ME KNOW IF THAT’S THE CASE THOUGH. Anyways, let’s take a deeper dive into what are the various benefits Eigenlayer brings about.

1. Increased Security for Protocols

The lowest hanging fruit in this case would be that protocols are able to tap on Ethereum’s security through re-staked ETH. New protocols will thus be able to experience a secure trust network despite just starting without sufficient amount of validators.

2. Improved Capital Efficiency

As mentioned earlier on, with Eigenlayer there is zero marginal cost of capital when setting up a new protocol / chain. There is no longer any inherent need for a token to be created to secure a trust network as the protocol can fully rely on Ethereum’s security. In addition, given that there is no need to fork out a relatively large sum of incentives to bootstrap validators, builders can deploy this capital into research and developing other aspects.

4. Value Alignment

Protocols or chains built on Eigenlayer are now connected through shared security, for they are tapping on the same pool of validators. With this new connection, they are now aligned in some way or another to act in the best behaviour.

5. High Degree of Flexibility

While tapping on Ethereum’s security, protocols building on Eigenlayer are given the control over their underlying mechanics such as consensus mechanism and slashing conditions. This will thus give the protocols control over which element they would like to prioritize, be it decentralization, scalability or any other factors required.

This addresses a huge dilemma that protocols have when they choose which chain to build on. Protocols building on Ethereum has always been restricted by the governing rules, leaving little space for them to innovate, which also brought about the migration of protocols to other chains such as Cosmos.

Cons of Eigenlayer

With all good things, there must be some not so good things, the downsides to Eigenlayer. Just like what goes up ought to come down. I am not fading this ‘bull market’ please don’t come at me. Anyways, here are some disadvantages to Eigenlayer that we ought to take note of.

Disclaimer: These cons are identified by me and might not be a 100% accurate given that the tech is still very nascent and still undergoing development. As such, do feel free to correct me by dropping me a dm on Twitter @jinglingcookies.

1. Single Point of Failure

The withdrawal credentials to slash the original $ETH state is given entirely to Eigenlayer. Should there be any form of manipulation or exploitation of Eigenlayer, it could result in honest nodes being slashed. This could severely reduce the level of security across Ethereum and other chains that are building on Eigenlayer.

2. Systemic Risk Pertaining to Security

Adding on to the point above, the interconnectedness of protocols when they build on Eigenlayer can in certain cases prove to be a weakness. Should there be a large number of re-staked $ETH being slashed, the collective security is then undermined. If the slashing occurs concurrently, it reduces the security across all protocols and this will result in networks being more susceptible to attacks.

This could even possibly impact the Ethereum’s trust network, which is the basis built upon by others. Imagine that even your transaction on Ethereum is insecure. Uh oh, not good news.

3. Difficulty in Securing Trust Network (Still?)

Wasn’t the crux of Eigenlayer to help provide others with a secure trust network? Yes, indeed it is. But the extent that a protocol is able to leverage on Ethereum’s trust network is dependent on the amount of re-staked ETH in their protocol.

It should be noted that stakers are free to choose which protocol they wish to secure. This could possibly result in a yield-chasing scenario once again, where users are incentivized to stake with protocols that offer the highest yield. Protocols that are not in the public eye and have not received as much re-staked $ETH would in this case try to attract users by offering high yield. This is contradictory to the point I mentioned above, where protocols are not needed to resort to validator incentives since they can leverage on Ethereum’s security.

Nonetheless, this is not cast in stone yet. Whether this occurs will be dependent on the rules set by Eigenlayer. Will there be a lock-up period before the re-staked $ETH can be redeemed? In that case, it reduces the extent of $ETH being re-staked in a protocol, and immediately pivoted to another in a span of hours just because of higher yield.

4. ‘Abuse’ of Control by Protocols

One of Eigenlayer’s value proposition is that of innovation. This is achieved by giving protocols the flexibility to decide on crucial aspects such as consensus mechanism and the slashing conditions. However, this could potentially lead to some protocols lowering their slashing conditions in order to attract users to stake with them (same yield earned with a lower downside). Despite the security being increased with more stakers, a lower slashing conditions makes it difficult to catch nodes that are misbehaving. If this misbehaviour is widespread and not contained, it could possibly lead to the whole chain being jeopardised and going down.

As mentioned in part two above, this control is also a factor that can contribute to the systemic risk.

Questions for Eigenlayer

Having read through articles, twitter threads, watched founder videos and listened to podcasts, there are still some areas which I will keep a lookout for in terms of Eigenlayer’s development. I have also included questions that I have regarding the mechanics of Eigenlayer.

1. Interoperability

Given that the protocols will be inter-connected through Eigenlayer, does this create opportunities for interoperability. This comes across as an interesting and critical aspect as the protocols built on Eigenlayer are able to have different consensus mechanisms, and the current landscape is not able to achieve efficient interoperability without compromising on security.

2. Value Accrual

There are many layers involved when a protocol uses Eigenlayer, which could include: (1) Ethereum (2) Eigenlayer (3) Liquid Staking Platform (4) User (5) Protocol building on Eigenlayer. In such a scenario, which layer does the value accrue to? This is a point that I am keen on knowing as it concerns the long term viability of Eigenlayer in terms of revenue sustainability.

Nonetheless, given that Eigenlayer is positioning themselves to be an infrastructure layer, I do foresee fees flowing to them once projects start building using Eigenlayer.

3. UI/UX

One of the biggest factor contributing to the success of Eigenlayer would be the adoption rate. Should there be minimal number of people who choose to re-stake, it’s not possible for the protocols to leverage on Ethereum’s secure trust network.

In this case, one of the biggest consideration will be the user interface (UI). Is it simple enough for users to commit to re-staking their $ETH? Will it be integrated with existing platforms that users are using, such as Lido? It seems to me that what Eigenlayer is building leans heavy towards the technical aspect, which could prove to be a barrier to entry to users. A good user experience (UX) will be needed to fast track the adoption and help protocols receive the security they need.

This also presents new opportunities for building of infrastructure to help with re-staking. Re-staking as a service (RaaS).

4. Gameplay

At the end of the day, the technology that Eigenlayer brings to the table is still nascent and has yet to hit mainnet. What we are looking at currently is the potential that Eigenlayer has, and the benefits it could bring about in the future. The eventual adoption of Eigenlayer when it launches will still be dependent on the go to market and marketing strategy employed to attract the following groups:

Users that will re-stale their $ETH

Protocols that are keen on leveraging Ethereum’s security

5. Blockchain Landscape

Eigenlayer allows protocols to build with the ability to choose the consensus mechanism they wish to employ amongst a few others characteristics. This makes it possible for the protocols to prioritize for what they are building, it could be scalability, decentralization or other aspects, despite being built on Ethereum.

What will this mean for the blockchain landscape? Will alt-L1s phase out given they are now able to achieve the same level of flexibility and sovereignty over their chains even though they are building on Ethereum through Eigenlayer.

Team

Before we end off, just a little plug about the founder.

Big brain? Yes. The founder Sreeram Kannan is an Associate Professor at the University fo Washington, Seattle, with the Department of Electrical & Computer Engineering. He also serves as the Director of the UW Blockchain Club.

Sreeram currently runs the information theory lab, which focusses on very relevant topics such as machine learning, blockchain systems and application of information theory in communication networks.

Smort. Smort. Smort.

Conclusion

At the end of the day, the development of Eigenlayer strives towards creating positive externalities for the blockchain ecosystem as a whole. Higher security, greater sovereignty, increased scalability. These are all factors that will help propel the development of use cases and applications.

This is definitely worth keeping an eye out for to see how the development goes.

I hope you liked this article. I spent many hours reading, watching and pondering over how best to present this in an easily understandable manner. If you liked what you read, do subscribe to my newsletter and drop me a follow at @jinglingcookies on Twitter! :D

Useful Links

Website: https://www.eigenlayer.com/

Twitter: https://twitter.com/eigenlayer

This is absolutely fantastic! Quite literally one of the most education, well thought out, and extremely useful article! Thank you for your tremendous contribution to me ever expanding knowledge base. I will use this and share with many others to come here and learn from this and you!!! Again..... THX!!