Stride: 1 Small Step for Me, 1 Giant Leap for Cosmonauts

Multichain liquid staking experience. Get the best of both worlds and earn both staking rewards and DeFi yields.

Twitter: @jinglingcookies

Note: Figures are as of 19th September 2022

Since the ETH merge, $ATOM has been experiencing an increase in the token price, with a peak increase of 18.46%. $ETH has done similar price action of 18.31%, just that it went in the opposite direction.

With the highly anticipated Cosmoverse taking place on September 26, there has been attention revolving around the dApps building on Cosmos, which could have contributed to the AT 0.00%↑ OM price action. To have a better understanding of Cosmos, do have a read on this article by Switcheo, which showcases a clear explanation of how Cosmos ecosystem works.

In this article, we will be taking a look at Stride, the 1st Cosmos-based liquid staking zone that recently raised $6.7 million in a seed funding round.

Without further ado, let’s step into this.

What is Stride?

First things first, let’s figure out what’s Stride.

Stride sets out to solve a particular area of inefficiency plaguing the DeFi vertical, which is the need for users to choose between:

(1) Staking Rewards

Lock up tokens for a certain period and earn passive yield.

(2) DeFi Yield

Participate in DeFi (lending, providing liquidity, etc.) to earn a higher yield, but this comes at a higher risk from the active market participation.

With Stride, this dilemma is resolved, for they will be able to earn both staking rewards and DeFi yield with their holdings. Let’s take a look at how this works.

How does Stride Work?

Let’s understand liquid staking through the example of $ATOM.

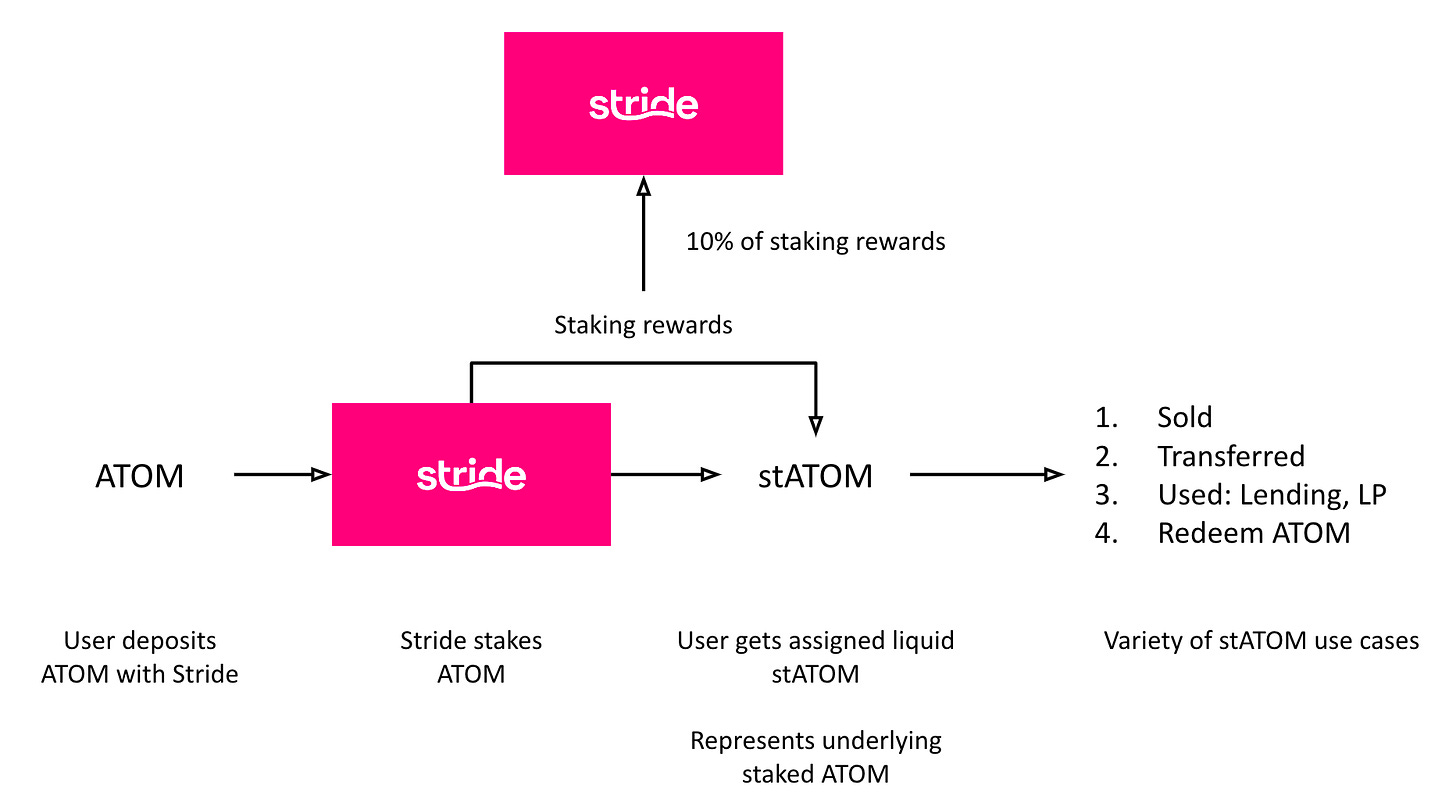

User deposits their ATOM with Stride

ATOM is staked by Stride

User will then be issued with stATOM (staked ATOM)

stATOM represents underlying staked ATOM and can be used to redeem ATOM at any time

stATOM can be sold, transferred or used in DeFi activities

To know more about liquid staking, here’s a video by Cosmos.

Click here to try out liquid staking on Stride.

Staking Rewards

When users carry out the above steps, the staking rewards are automatically compounded and accrued to stATOM.

To put it simply, when 1 stATOM is issued, it can be used to redeem 1 ATOM. After a year, presuming the staking APR is 15% (with monthly compounding), users will be able to redeem 1.1608 ATOM.

All this is done automatically, without the users having to manually claim their staking rewards, making it a lot more convenient. No need to try and figure out which button to click.

DeFi Yields

Despite stATOM being issued on the Stride blockchain, by using the native Cosmos IBC bridge, it is possible to send stATOM easily and securely to any blockchain built on Cosmos (provided that they have enabled IBC), making it possible to use stATOM to participate in the DeFi activities available on the different chains. This seamless, optimal interoperability between supported assets has been enhanced with the recent Cosmos v3 Theta upgrade.

As of this current stage, stATOM can be used to provide liquidity to the ATOM/stATOM pool on Osmosis, and users will be able to earn LP fees from this.

Liquid Staking Fee

With the above service comes a fee, where Stride takes 10% of the staking rewards from the staked assets. The amount of fee taken by Stride is adjustable by Stride on-chain governance, using the native STRD token. There is also the possibility that users will be able to participate in on-chain governance through their staked tokens in the future.

This is a characteristic that differs from most other blockchains and dApps, which usually provides their services for free. Nonetheless, this comes across as a good characteristic to me, for it is more sustainable and grants the ability for the team at Stride to continue growing and improving their service.

Key Features of Stride

Now that we have got a better understanding of what Stride does, it’s time to dive a little deeper to see what is it that Stride has got to offer.

Market Participation | Capital Efficiency

Clearly, with the availability of stTokens, users will be able to actively participate in the market while staking their underlying assets. This will make the ecosystem more robust, as the higher liquidity contributed by liquidity providers will attract more users.

More importantly, users will no longer have to make a distinction as to whether they want to stake their tokens or forgo staking and go for DeFi participation instead. This comes across as a maximisation of the efficiency of capital.

Minimalism | Ease of Use

At Stride, a great deal of emphasis is placed on creating a minimalist design, where they are purely focused on providing a liquid staking solution. This is a user-friendly design, as it will be less complicated and much easier to use when there is only one product. An easy to use product is definitely appreciated by the broader market, and especially by me, for I sometimes can’t differentiate whether cereal or milk comes first don’t judge me please.

Security

Liquid staking is a considerably nascent space that is being explored. With that being said, it comes with the connotation that there might be higher risks. Stride understands this and have taken measures to safeguard against such security issues, where they are currently undergoing audit by two of the leading blockchain auditors: Certik and Oak Security. With the recent hacks and exploitations going on, higher security definitely sounds very enticing.

Tokenomics

Stride has announced an airdrop of the Stride token, and the details can be found here: https://stride.zone/blog/stride-airdrop-details

I will be writing another article to go through their tokenomics. So do keep a lookout for that!

Future Developments: Small Steps to Big Steps

Stride is still in a relatively early phase of development. Nonetheless, there are a significant number of developments up and coming, that we can keep our eyes on.

1. Increase in Tokens Supported

Starting with ATOM, Stride will be moving on to support OSMO and JUNO. Stride has the vision of providing liquid staking for 15 Cosmos L1 assets, including that of Secret Network, Evmos, Stargaze, Sei Network and Kujira. And many many others in time to come.

This will be a critical update that I will keep my eyes on, to see whether Stride is able to onboard more assets as they have set out to, as this is a very clear indicator of the robustness of the Stride ecosyytem. And the other point would be to identify whether there might be some security issues that comes to Stride as they increase the number of tokens supported.

2. Switching Cost Rebate Program | Liquid Staking Module (LSM)

Stride has identified that there will be a huge switching cost that users will have to pay if they wish to join Stride. This is because users are required to unstake their current staking positions, before the tokens will be made available for staking with Stride. During this unstaking period, users will not be able to obtain the staking rewards.

To tackle this, Stride has put in place a Switching Cost Rebate Program. Based on the number of tokens deposited, Stride assumes that these tokens had to be unstaked, and will calculate the amount of staking rewards missed out. After which, Stride will compensate the users with Stride tokens. However, I have some qualms with regards to this program, as the assumption that all tokens deposited had to be unstaked is not likely to be true, since users could have just bought the tokens. And secondly, should Stride gain traction, it will become difficult for them to compensate all users, which might lead to some users showing their dismay.

Nonetheless, the team is looking to add the Liquid Staking Module (LSM) that they are building currently. LSM is basically an open-source module and the crux of it is: Staked tokens can be converted into liquid staked tokens without the need to unstake and miss out on staking rewards (during unstaking period). This is something that I personally am bullish on, for it makes it more seamless for users to deposit with Stride, improving the user experience drastically.

3. Security | Rate-limiting Capability

With rate-limiting capability, Stride will be able to temporarily halt activity should there be any suspicious fluctuations, safeguarding the deposits. Right now there is little information on this characteristic, and we will have to wait for more information to be pushed out by the team.

Team at Stride

Before I end this article, I would just like to say that the team at Stride is a highly compelling one.

Co-founder Vishal Talasani previously founded a hedge fund which was acquired by Dark Forest Technologies. He also took on the role of a quant researcher at Bridgewater Associates, the largest hedge fund in the world. Alongside him are his co-founders Edmunds (expertise in machine learning and macroeconomics) and Salzmann (expertise in product and engineering).

As evident, the team has very diverse skill sets and have plenty of experience in their specific fields. I look forward to seeing the synergy they bring to Stride.

Conclusion

Stride is definitely building a service that is highly desired by the market, helping users achieve capital efficiency. However, with that being said, it should be understood that liquid staking is a highly competitive space, with multiple other protocols working on the same product, examples of which are Lido, pStake and Quicksilver.

There are indeed efforts made by the team in growing and making the protocol much more robust, by:

Increasing the number of tokens supported to grant diversity for the users

Creating LSM that can make the process of depositing with Stride more seamless

Ensuring that the users’ funds are as safe as possible with rate-limiting capability

I will be looking forward to see Stride support more Cosmos assets, and keep a lookout for the traction that they are gaining in terms of TVL. More importantly, it will be critical to see how Stride performs against other competitors, to have a gauge of the potential market size they can address.

I will be taking the next steps to evaluate the tokenomics to understand the value accrual to the native token $STRD. So do keep a lookout for that!

If you enjoyed the article, do subscribe to my Substack and follow me on Twitter @jinglingcookies!

Useful Links

App: https://app.stride.zone/

Stride Twitter: https://twitter.com/stride_zone

Stride Blog: https://stride.zone/blog

Stride Airdrop: https://stride.zone/blog/stride-airdrop-details

Stride Tokenomics: https://stride.zone/blog/stride-tokenomics

Stride FAQ: https://stride.zone/faq